14% of people watch on their friends’ or family members’ accounts.

#Netflix stock price before split free#

Many people enjoy free access on Netflix because of account sharing. 2,235 people worldwide made up the survey’s sample size. Approximately 33% of all Netflix customers share their credentials with at least one other user outside the home, according to research conducted by Magid in late 2020. The corporation experimented with the concept of adding an extra security barrier to prevent access from those whose whereabouts differ from those of customer accounts. However, it is bad for the huge streaming company’s bottom line. Instead of several, there is just one subscription there. Netflix memberships are frequently shared by friends and family. The Netflix stock has been affected by several factors, some of which have been listed below:

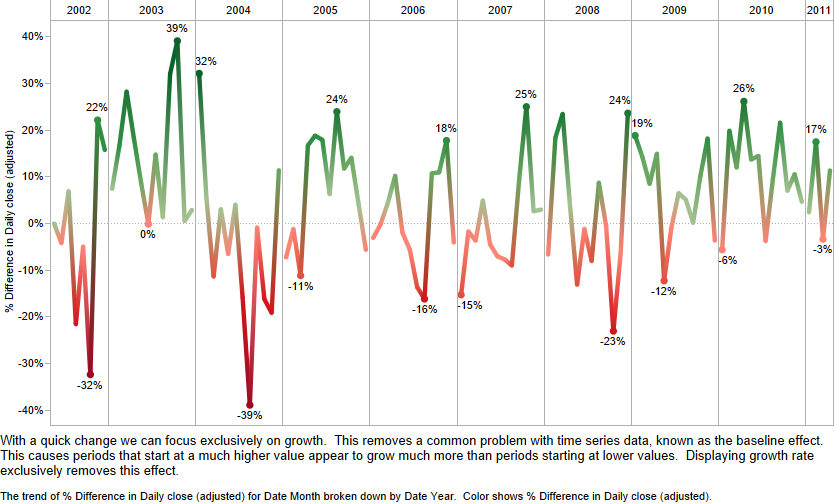

With over 45 million customers, competitors such as Hulu are gaining ground.īefore you buy NFLX stock in India, it is important to understand its current situation and the factors that influence the shifts in Netflix stock. The largest global provider of VoD services at the moment is Netflix. According to reports from Yahoo Finance, the revenue generated by Netflix is expected to climb at a quarterly rate of 16% over the previous quarter. These annual revenue figures for Netflix demonstrate the company’s strong global reputation and potential for continued growth. The same Statista analysis estimates Netflix’s yearly income at $30B. During the first quarter in 2022, Netflix’s revenue was over $7.87 billion, rising from over USD 7.16 billion over the equivalent quarter of 2021, according to a Statista research. The Netflix stock had the biggest percentage single-day decline ever the day following the release of this news, plunging by more than 35%. During the first quarter in 2022, the corporation reportedly lost over 200,000 users. There were 221.64 million paying Netflix subscribers as of the third quarter of 2021. Even so, it still boasts a 29.88% stock price CAGR since its IPO in the year 2002. It has underperformed the most compared to the other FAANG companies. Visa split 4-for-1 in March.Netflix stock, a member of the infamous FAANG, has fallen 65% from its peak as on 20th Aug 2022. Other higher-priced stocks have split this year, led by Apple’s 7-for-1 move, which took effect this month. Others have begun selling programming to Hulu and Inc.

Netflix, which has been aggressive about international growth, closed out its first quarter with 62.3 million members, almost a million more new subscribers than it had predicted.Īs consumers spend more time watching video over the Internet, a number of large media companies have attempted to replicate Netflix’s success with their own online-only services. The company has evolved from a DVD rental service to one of the active producers of TV, documentaries and films, with a long-term budget that approaches $10 billion.

#Netflix stock price before split tv#

The company’s market capitalization has soared eightfold to more than $40 billion since 2012 as Netflix expanded its pioneering Web-based TV service to more than 50 countries and signed up more than 62 million subscribers worldwide. The last time Netflix split its stock was in 2004.Ī stock split makes the company more accessible for investors and employees who want to buy in but can’t pony up hundreds of dollars for one share. Netflix was widely expected to split its stock after announcing plans to do so in April and then gaining shareholder approval to increase its number of authorized shares this month, which is a preliminary step in a split. The 7-for-1 split takes effect July 14 and is payable to shareholders of record as of July 2, the Los Gatos, California-based company said in a statement late yesterday. The shares have almost doubled this year. Shares were up 1.6 percent at $691.72 at 9:44 a.m. Netflix ( NASDAQ:NFLX) rose in morning trades after the world's largest subscription streaming service declared a share split.

0 kommentar(er)

0 kommentar(er)